- #YNAB BUDGETING FOR LONG TERM SAVINGS HOW TO#

- #YNAB BUDGETING FOR LONG TERM SAVINGS UPGRADE#

- #YNAB BUDGETING FOR LONG TERM SAVINGS FULL#

- #YNAB BUDGETING FOR LONG TERM SAVINGS FREE#

This tool tracks your net worth and lets you compare to the median U.S households within your age bracket.

#YNAB BUDGETING FOR LONG TERM SAVINGS FULL#

Your financial life is probably full of many numbers that make it hard to know your net worth.

/YNAB-4863635555d64170a40877607c8b8cbd.jpg)

#YNAB BUDGETING FOR LONG TERM SAVINGS HOW TO#

It identifies all the hidden fees that are not visible to the naked eye and make recommendations on how to reduce them. Fee assessor – This tool shows you all the fees you pay on your accounts.Once you assemble all these, you can develop a budget, set goals, and strategies to help you achieve them. This includes bank accounts, retirement plans, loans, credit cards and investment accounts. It lets you consolidate your financial life in a single application.

#YNAB BUDGETING FOR LONG TERM SAVINGS FREE#

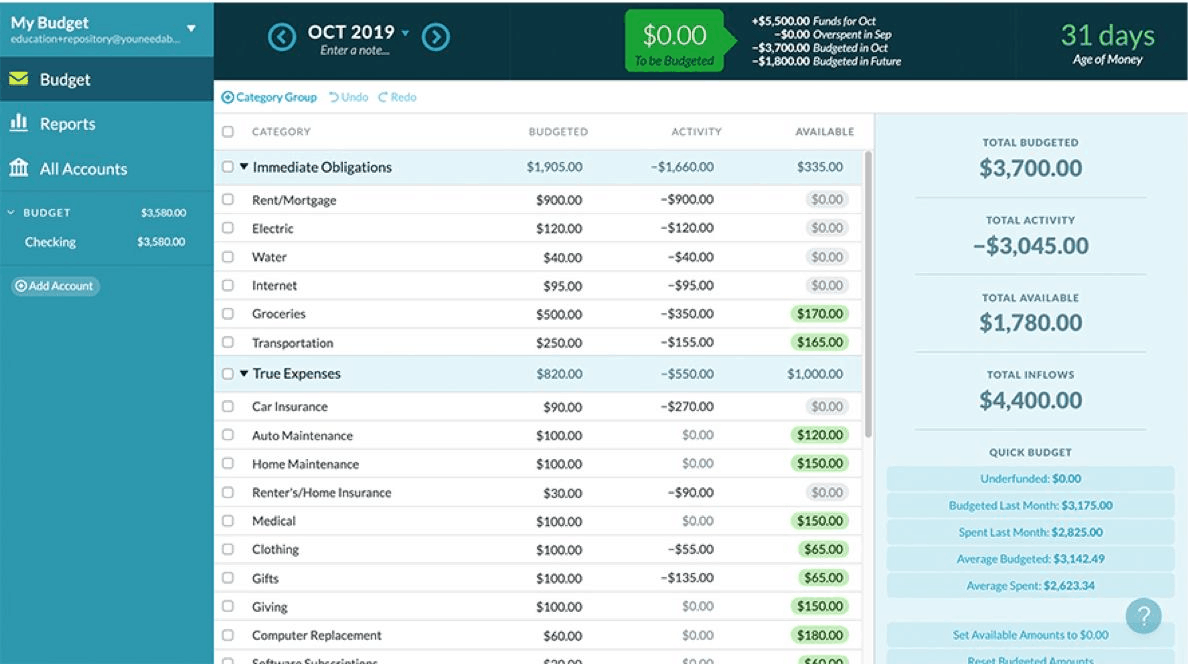

The free version of Personal Capital is a financial software. Personal Capital and YNAB both employ different approaches to financial management.

The goal of YNAB is to give you control over your money and how you spend it. Budgeters save an average of $600 in their first two months and over $6,000 in the first year on YNAB. It worked so effectively that he decided to market it to the public, giving rise to YNAB as we know it. The idea behind it was to help him and his wife to develop and maintain a realistic budget. YNAB was started back in 2003 by CPA Jesse Mecham. (Here, check more about how Personal Capital compares with Wealthfront, Betterment, and Mint, before deciding!) YNAB The goal of Personal Capital is to give you a clear picture of your financial status, monitor your investments proactively and prepare for retirement.

#YNAB BUDGETING FOR LONG TERM SAVINGS UPGRADE#

Most clients start with the free version and then upgrade to the paid version once they accumulate a considerable asset base. The paid version has over 18,000 clients who own more than $8 billion in assets. We will dwell a lot on the free version here, as the premium one is a Robo-advisor service for clients with over $100,000 in assets. It offers two distinct services that are differentiated by the free and paid versions. Personal Capital was founded in 2009, and it has over 2 million users. They do a great job of helping you to manage your finances, albeit differently. In the financial planning tools space, they are probably the two names that you will come across first, alongside Mint. Personal Capital and YNAB are very popular, and this goes down to the features they offer.

0 kommentar(er)

0 kommentar(er)